Related resources

![When can I enroll in Medicare Part D?]()

When can I enroll in Medicare Part D?

3-minute readWhether you’re on the cusp of turning 65 or have already made it there, Medicare is probably on your mind. That’s the government-run program through which millions of Americans ages 65 and older — plus some people with end-stage renal disease or certain disabilities — get their health insurance. And Medicare can be confusing. That’s […]

![How to review your health insurance policy: 5 useful tips]()

How to review your health insurance policy: 5 useful tips

3-minute readWhen it’s time to renew your health insurance policy, what should you look for? In most cases, you’ll review your health insurance policy, evaluate your options, and choose a plan during Open Enrollment beginning on November 1, for coverage beginning Jan. 1.1 Maybe you’ll renew your existing health insurance policy. Or maybe some things […]

![When is Open Enrollment for 2024?]()

When is Open Enrollment for 2024?

3-minute readThe 2024 Open Enrollment Period (OEP) begins November 1, 2023, and ends usually January 15, 2024, in most states. Because January 15 falls on a federal holiday in 2024, OEP will extend until midnight, January 16 in many states.1 The chart below shows the 2024 OEP dates for the states that use the federal ACA […]

![When is the Medicare Annual Enrollment Period?]()

When is the Medicare Annual Enrollment Period?

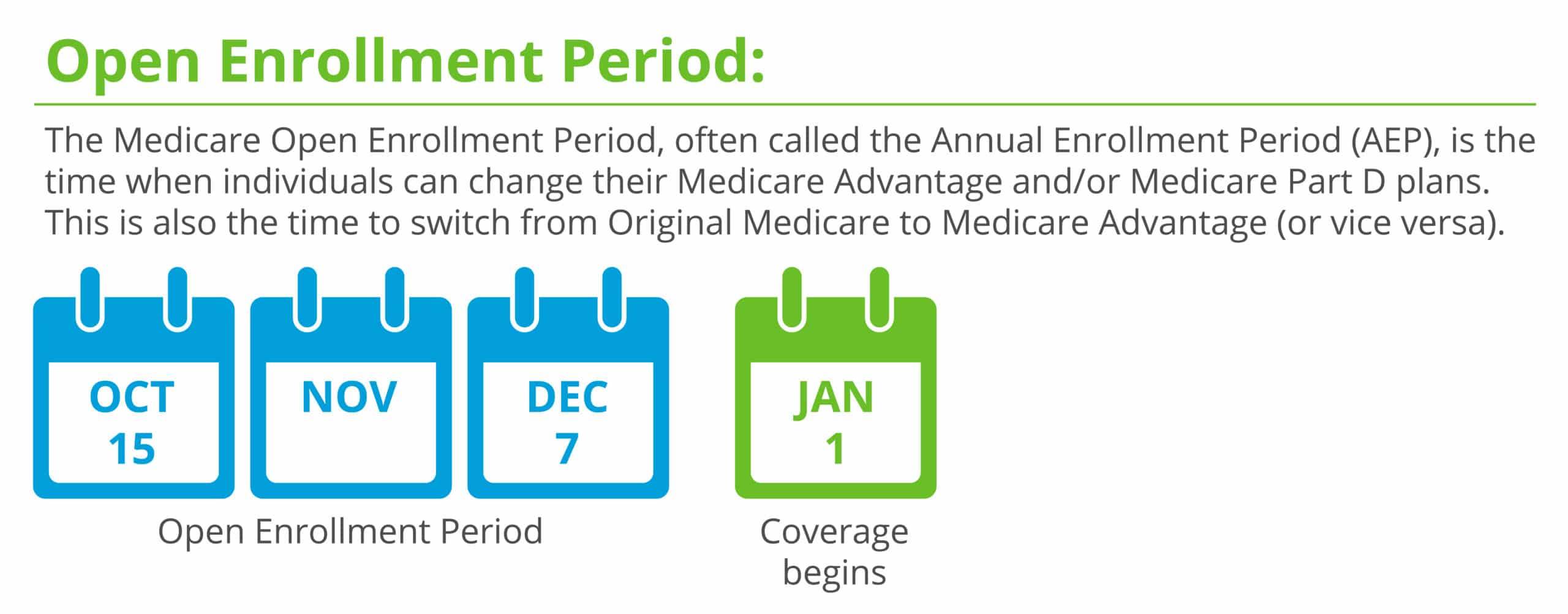

6-minute readWhen is the Medicare Annual Enrollment Period? The Medicare Annual Enrollment Period occurs during the fall between October 15 and December 7, 2023.1 When you enroll during this time, your coverage begins January 1, 2024. When you start to see and hear advertisements for the Medicare Annual Enrollment period on TV, social media, radio, and […]

![What happens when my health insurance isn’t renewing?]()

What happens when my health insurance isn’t renewing?

2-minute readYou may have received a notice that your plan was not being renewed this upcoming year. First, don’t worry. Your current policy most likely can still be used through the end of the year, and you will have time to replace it before it expires. Even if your coverage is ending before the end of […]

![Is Your Medicare Cost Plan Ending?]()

Is Your Medicare Cost Plan Ending?

2-minute readMedicare Cost Plans are hybrid Medicare plans that share features from Medicare Advantage and Medigap supplemental insurance plans. They’re offered by private insurance companies. Why Are Medicare Cost Plans not Renewing? To meet competition requirements, Medicare Cost Plan contracts were not renewed in areas with more than one Medicare Advantage plan available. What are the options for […]

![Medicare Frequently Asked Questions (FAQ)]()

Medicare Frequently Asked Questions (FAQ)

4-minute readMedicare can be hard to understand, especially if you’re close to turning 65 and this is your first experience with it. To get you started, we’ve provided Medicare answers to some of the most common Medicare FAQs.. Who Qualifies for Medicare? To qualify for Medicare, you need to be a U.S. citizen or legal resident […]

![Affordable Care Act Insurance: Renewing Your Plan]()

Affordable Care Act Insurance: Renewing Your Plan

3-minute readWant to renew the Affordable Care Act (ACA) insurance plan you had last year? It’s the easiest way to go. Right? If your plan provided you with the health insurance you needed for healthcare, doctor’s visits, medications, and other healthcare needs, automatic re-enrollment might make sense. Were the premiums and out-of-pocket expenses affordable? Did you […]

![Find the Right Plan With These Medicare Tips]()

Find the Right Plan With These Medicare Tips

3-minute readFor Americans turning 65 or older, the beginning of fall is also the beginning of the Medicare season. Whether you are new to Medicare or have been using it for years, each season brings changes to your plan options. These five Medicare tips can help you verify that you are getting the most out of […]

![When Is the Medicare Advantage Enrollment Period?]()

When Is the Medicare Advantage Enrollment Period?

3-minute readPreparing for the Medicare Advantage Enrollment Period? HealthMarkets can help you decide if applying for Medicare Advantage is right for you. What Is Medicare Advantage? Medicare Advantage (MA) is a plan that provides an alternative way to get Original Medicare Part A hospital insurance, Part B medical insurance, and extra benefits that Original Medicare doesn’t […]

![When Can I Apply for Medicare?]()

When Can I Apply for Medicare?

2-minute readHave you been wondering “When can I apply for Medicare?” It’s a commonly asked question. Most Americans become eligible to receive Medicare benefits once they turn 65 years old. However, depending on your circumstances, you may qualify for Medicare even earlier. Do I Automatically Get Medicare When I Turn 65? If you’re receiving Social Security […]

![What a Health Insurance Cancellation Letter Really Means]()

What a Health Insurance Cancellation Letter Really Means

3-minute readWhen you received your health insurance cancellation letter, it may have come as a surprise. Luckily, it’s not as bad as it might seem. You’ve got plenty of time to take action, replace your policy, and ensure you have health coverage. HealthMarkets can help explain: Why this happened and how it can affect your coverage […]