Related resources

![Discount dental plans: What to know before you buy]()

Discount dental plans: What to know before you buy

4-minute readHealthMarkets helps you decide whether you should consider a dental discount plan, which could help you save money.

![Can you go to the dentist while pregnant?]()

Can you go to the dentist while pregnant?

3-minute readHaving healthy teeth and gums can help you have a healthy pregnancy. In fact, staying on top of your checkups and cleanings is strongly recommended. But there are some procedures that should wait until after delivery. We’ve got the details you need to know before scheduling a visit to your dentist when you’re pregnant, what […]

![Top 4 Things to Know About Supplemental Dental Insurance]()

Top 4 Things to Know About Supplemental Dental Insurance

4-minute readIt’s easy to spend hundreds, even thousands, on dental care; and plenty of people may find themselves in that position. But shopping for a dental plan can be confusing. Here’s some important information to know if you’re considering dental insurance: #1: Dental Insurance Covers Some Services at 100%—But Not Everything Dental insurance covers a portion of your dental care costs. You pay a monthly premium and often […]

![Dental anxiety: How to have a more comfortable tooth cleaning at the dentist]()

Dental anxiety: How to have a more comfortable tooth cleaning at the dentist

4-minute readFor some people, going to the dentist can be an uncomfortable experience. Maybe you don’t like the sounds of the instruments buzzing or the feeling of having someone else’s hands inside your mouth. If you avoid seeing the dentist for any of these reasons, you’re in good company. About 36% of American adults have general […]

![Finding full coverage dental insurance that fits your needs]()

Finding full coverage dental insurance that fits your needs

2-minute readWhen trying to keep dental insurance affordable, HealthMarkets Insurance Agency can help you find the full coverage you need with an array of benefit options that provide access to network providers.

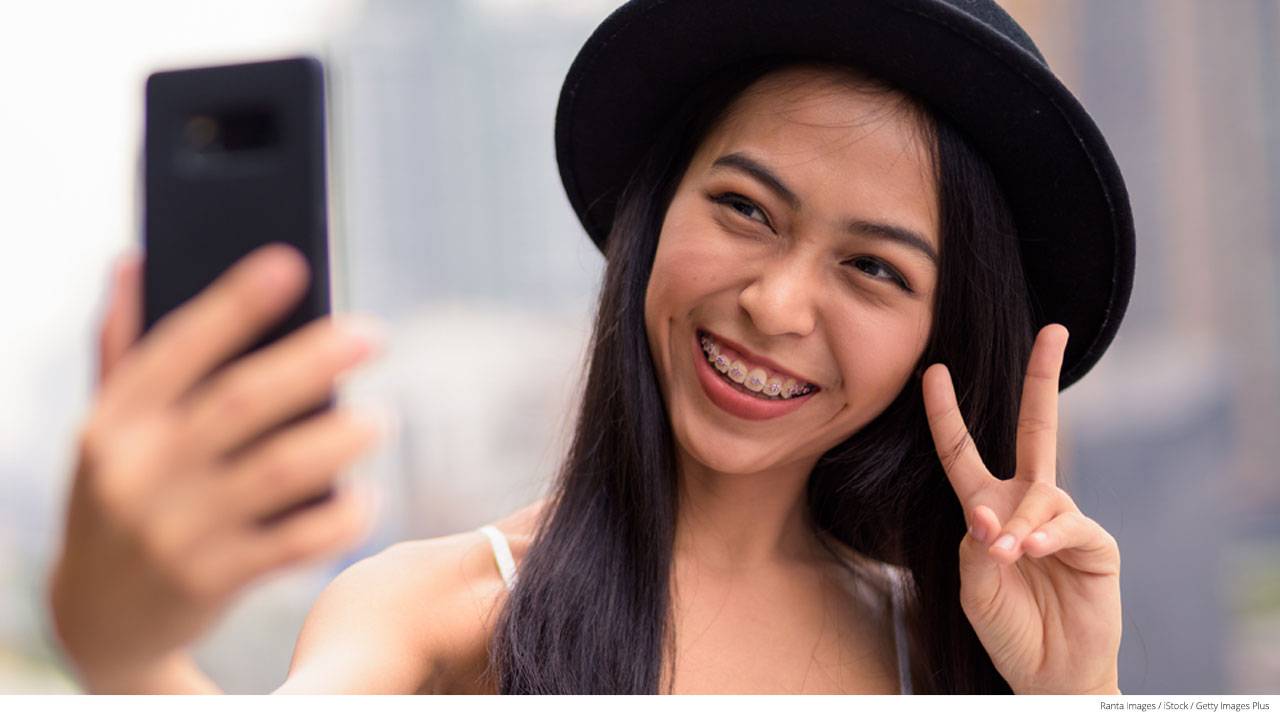

![Supplemental Orthodontic Insurance: 4 Smile-Friendly Tips]()

Supplemental Orthodontic Insurance: 4 Smile-Friendly Tips

3-minute readNeed braces for you or your kid? If you’re worried it’s going to be expensive, you’re not alone. The good news: with supplemental orthodontic insurance, it could be more affordable than you think. Without insurance, the average cost for braces is $5,000 to $6,000.1 But the more orthodontic care you need to fix your teeth, […]

![Oral cancer: The type of cancer your dentist can help diagnose]()

Oral cancer: The type of cancer your dentist can help diagnose

5-minute readWhen you go to the dentist to get your teeth cleaned every 6 to 12 months, you may be surprised to find them feeling your gums, studying the roof of your mouth, and even peeking under your tongue. This quick exam is an important way of checking for signs of oral cancer. Cancer may not […]

![What’s the difference between an orthodontist and an endodontist?]()

What’s the difference between an orthodontist and an endodontist?

4-minute readChecking in with your family dentist is a good first step to maintaining good oral health. If you’re having dental concerns, they can assess your problem and refer you to the right specialist. But it’s helpful to know who does what. Keep reading to find out what the difference is between these two dental specialists. […]

![What dental X-rays reveal about your teeth]()

What dental X-rays reveal about your teeth

3-minute readYour dentist’s assistant just announced that you’re due for X-rays today — and now you’re wondering why your dentist needs to take pictures of your teeth if they’re going to be digging around in your mouth anyway. Glad you asked. Dental X-rays can reveal quite a bit about what’s going on inside your mouth and […]

![6 Dental Emergencies and How to Deal With Them]()

6 Dental Emergencies and How to Deal With Them

4-minute readYou wake up with a toothache. Your first thought: Ouch! Your next thought is: How much will this cost once I sit in the dentist’s chair? There’s no doubt that dental emergencies can be stressful. The good news is that if you have dental insurance, it will often cover a portion of the cost, says […]

![You have health insurance, but what about vision and dental insurance?]()

You have health insurance, but what about vision and dental insurance?

2-minute readIt’s important to have insurance for health, dental, and vision. But does one plan cover them all, or do you need separate plans for each type of coverage? The simple answer is: you may need to shop for individual plans to get coverage that fits your needs. Does health insurance cover dental care? Health insurance […]

![Adult Braces: What Are Your Options, and How Much Do They Cost?]()

Adult Braces: What Are Your Options, and How Much Do They Cost?

3-minute readMany people canceled medical appointments during the pandemic, and at least one dental specialist has seen an increase in patients seeking orthodontic work (that’s the practice of diagnosing, preventing, and straightening out teeth and jaws). “We’ve seen a big uptick in adults pursuing orthodontics in the last year or so, which I’ve dubbed the ‘Zoom […]