Use this simple guide to navigate the health insurace marketplace

Need a little help navigating the healthcare marketplace?

This simple guide will help you understand your options and find a plan that works for you. You’ll also learn about…

- The three main goals of the Affordable Care Act

- The 3 types of healthcare marketplaces

- Federal and state open enrollment periods

- States that charge a penalty fee for not having health insurance

- The easiest way to find a health plan that fits your needs

The 3 main goals of the Affordable Care Act

The Affordable Care Act (ACA) has three major goals:1

- Make health insurance more affordable

- Make health insurance more accessible

- Expand the Medicaid program in every state

If you’re looking for affordable health insurance, you have access to a wide range of plans available through a healthcare marketplace.

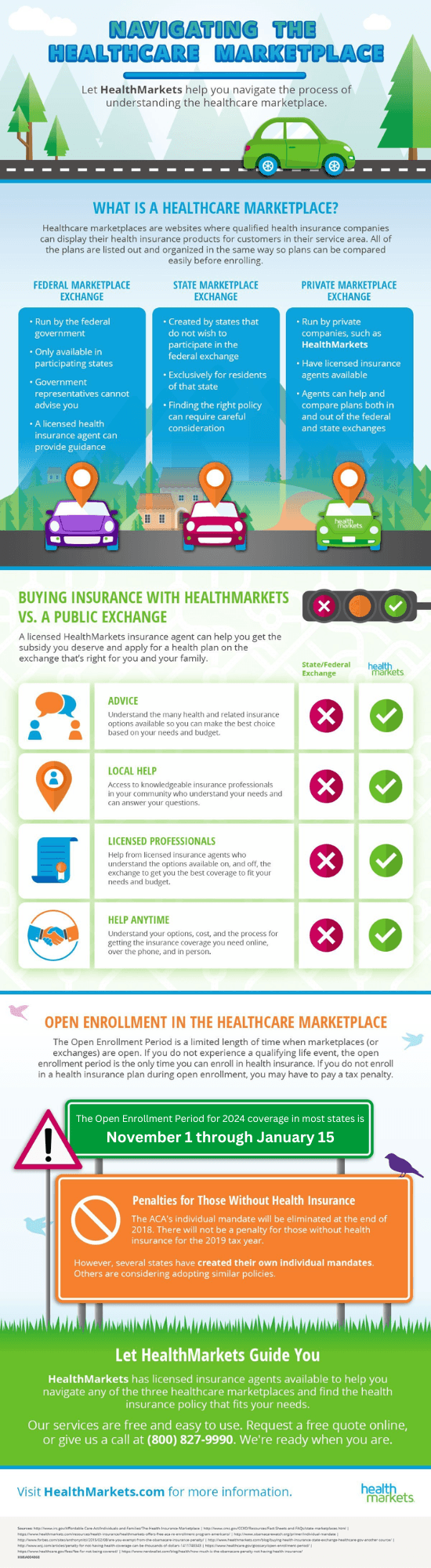

3 types of health insurance marketplaces

A healthcare marketplace or health insurance marketplace is a shopping enrollment service for health insurance.2 These marketplaces are set up online by:

- The federal government

- Your state

- Private insurance companies7

Here’s how the 3 types of healthcare marketplaces work:

1. Federal Marketplace Exchange

The federal government runs the federal healthcare exchange.

- It can be accessed online or over the phone with a government representative. This exchange is only available to participating states.

- A licensed health insurance agent can provide you with guidance and help you enroll in a plan through the federal marketplace exchange, but government representatives cannot advise you.

- If a licensed agent guides you or helps you enroll through this marketplace, your plan costs will not change.

2. State Marketplace Exchanges

Currently, 33 states participate in the Federal Marketplace Exchange. However, 17 states and Washington D.C. operate their own marketplace exchanges.3

- States that do not wish to participate in the federal marketplace exchange must create a state exchange or State Partnership Marketplace exclusive to their residents.

- While health insurance plans are accessible in federal and state marketplaces, finding the right policy for you and your family can require careful consideration.

3. Private Marketplace Exchanges

Private companies, such as HealthMarkets, run private health insurance exchanges where U.S. residents can search for plans.

- Exchanges like these have licensed insurance agents available to help consumers.

- They can help you learn about options, compare thousands of plans both in and out of the federal and state exchanges, and help you enroll once you find a plan that works for you.

Healthcare marketplaces: One thing in common

Each healthcare marketplace website might look a little different and offer different insurance plans and products, but they have one thing in common:

- All of the plans are listed out and organized in the same way.

- So when you’re searching for health insurance, it’s easy to find:

- Coverage information

- Price comparisons

- Additional features (such as dental or vision coverage)

This makes it a lot easier to review all your options before you enroll in a plan.

Here’s a simple breakdown of what shopping for health insurance through any of the 3 healthcare marketplaces looks like:

- You go to one of these healthcare marketplaces online

- You’ll find a list of qualified health insurance companies. Each company offers one or more health plans and other insurance products

- You can search the marketplace for the type of health coverage you want, based on price, type of plan, features (like vision and dental coverage), and easily compare plans

- Once you find a plan you like, you can enroll through the marketplace.

Choose a health plan: Why you’ll get more help in a private marketplace

By law, government representatives can’t offer advice. They also cannot offer plans that aren’t sold exclusively in the federal (or their state) exchange.

However, a licensed insurance agent can offer advice and help you select a plan on a federal or state exchange.4

Get ready for the Open Enrollment Period

The Open Enrollment Period is a limited length of time when marketplaces (or exchanges) are open.5

- If you do not experience a qualifying life event, the Open Enrollment Period is the only time you can enroll in health insurance. Regardless of which healthcare marketplace you wish to shop, you should be aware of the important enrollment dates and deadlines.

The Open Enrollment Period for 2024 coverage in most states is November 1, 2023 through January 15, 2024.

Be sure to check your state’s Open Enrollment Period.

- During this time, all health insurance marketplaces should be open for Americans to shop, compare, and enroll in a healthcare plan.

- You can also re-enroll in your plan during this period, should your insurance provider have the same or a similar plan available.

- If you do not enroll in a health insurance plan during this time, you may have to pay a tax penalty, depending on your state’s requirements.

No health insurance? Some states charge a penalty fee

Beginning in 2019, the ACA’s individual mandate is no longer in effect.

But some states have adopted their own health insurance mandates. Before you opt out of coverage, check your state’s requirements. If you don’t, you may be stuck paying a tax penalty.

Health insurance is mandatory in the following states:6

- California

- Massachusetts

- New Jersey

- Rhode Island

- Vermont

- Washington D.C.

Need help choosing a health insurance plan?

We can help. Our team of more than 3,000 licensed insurance agents can help you navigate any of the three healthcare marketplaces to find the health insurance policy that fits your needs.

Find a licensed insurance agent in your area or call us at (800) 827-9990 for more information.