Related resources

![What Is the difference Between copayment and coinsurance?]()

What Is the difference Between copayment and coinsurance?

2-minute readIf you’ve never had health insurance, you might not be familiar with the difference between a copayment and coinsurance. Understanding these two terms can help you better understand your out-of-pocket expenses for the health insurance plans you’re considering so you can choose a plan that is right for your needs. Copayment and coinsurance are both […]

![The basics of health insurance: numbers you need to know]()

The basics of health insurance: numbers you need to know

2-minute readShopping for health insurance can be overwhelming. Whether it’s your first time or your annual review, knowing the basics can help you effectively compare plans and find coverage that suits your needs and budget. An easy way to start is by understanding the basics of health insurance costs. Premiums The premium is the amount you […]

![5 myths you may have heard about hearing aids]()

5 myths you may have heard about hearing aids

3-minute readRoughly 15% of American adults (over 40 million people) report having a hard time hearing. While there’s no way to restore hearing, hearing aids can help you make the most of the hearing you do have. So why don’t more people use them? Some people think hearing aids are too big or that they cost […]

![Are vaccines covered by insurance?]()

Are vaccines covered by insurance?

3-minute readThe Affordable Care Act (ACA) expanded healthcare coverage to include preventive services. These services are provided without a deductible, copay, or coinsurance. So, are vaccines covered by health insurance? All Affordable Care Act-qualified health insurance plans cover certain vaccines Which vaccines are covered will vary slightly depending on age (under or over the age of […]

![Medicare out-of-pocket costs: where is your money going?]()

Medicare out-of-pocket costs: where is your money going?

4-minute readIf you’re eligible to receive Medicare coverage, you may still be responsible for some Medicare out-of-pocket costs. Depending on the plan you choose and your yearly income, you will have more or less to pay in healthcare expenses. HealthMarkets can help break down those expenses for each Medicare part. What Are Medicare Out-of-Pocket Expenses? Premiums, […]

![Out of Network Providers: 5 Things to Know Before You Go]()

Out of Network Providers: 5 Things to Know Before You Go

4-minute readWhat happens if you need out-of-network providers for medical care? It happens. Maybe you need to see a specialist who isn’t in your plan’s network. Maybe you have established relationships with out-of-network healthcare providers. Maybe it’s logistically more convenient to see out-out-of-network providers. For example: You’re in the process of moving. Your health plan recently […]

![What You Need to Know About Surprise Medical Billing]()

What You Need to Know About Surprise Medical Billing

6-minute readHere’s something you can look forward to this year: an end to unexpected, or “surprise,” medical bills. That’s thanks to the new federal No Surprises Act, which took effect January 1, 2022. “Many people reasonably assume that they won’t get billed by some random provider they had no role in choosing. So they may not […]

![Deductible vs. Out-of-Pocket Limit: What’s the Difference?]()

Deductible vs. Out-of-Pocket Limit: What’s the Difference?

2-minute readUnderstanding health insurance terminology can help you choose the right plan for yourself or your family members. One issue some people find confusing is the difference between a plan’s deductible vs. the out-of-pocket limit, both of which represent points at which the insurance company pays for all or some of your care. Why are the […]

![The Medicare Part D Donut Hole: What It Is & How to Prepare For It]()

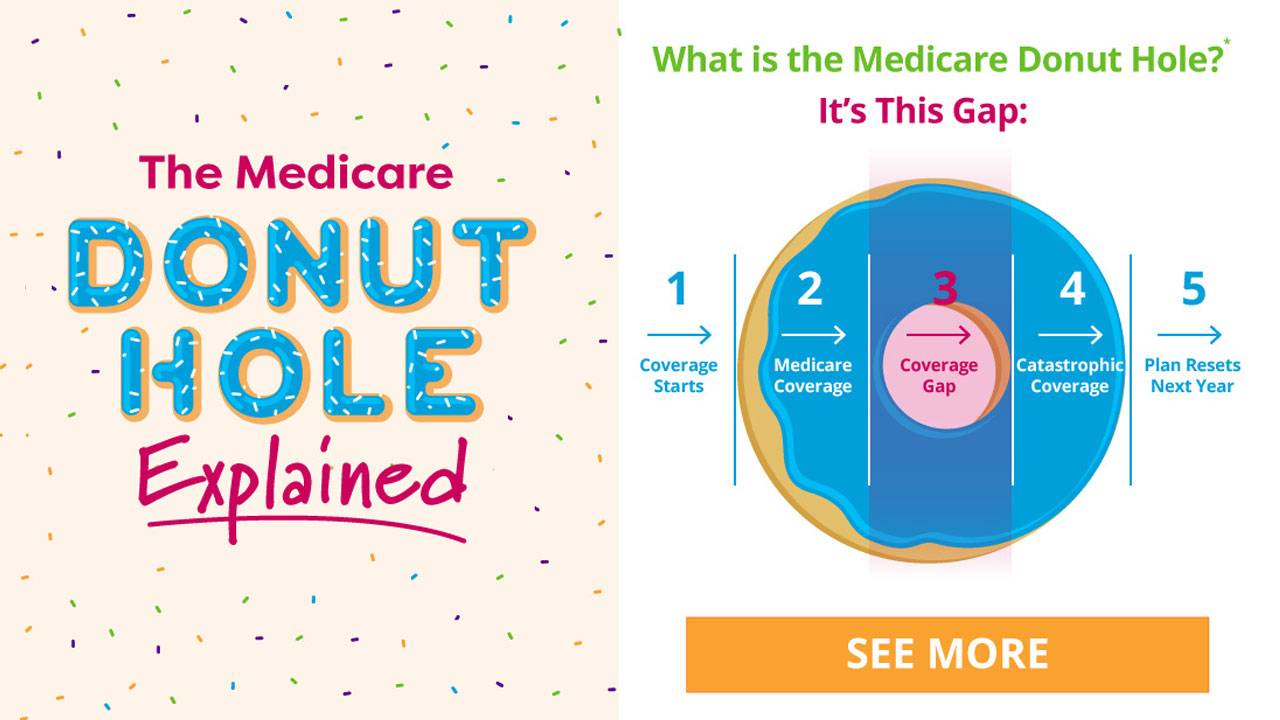

The Medicare Part D Donut Hole: What It Is & How to Prepare For It

2-minute readMedicare Part D, also known as a Prescription Drug Plan (PDP), helps people with Medicare pay for their medication. These plans are purchased from private health insurance providers and come with a variety of benefits and premiums. But for some high-usage Medicare enrollees, they can also come with unexpected expenses, called the Medicare Part D […]

![The Medicare Part D Donut Hole: What It Is & How to Prepare For It]()

The Medicare Part D Donut Hole: What It Is & How to Prepare For It

2-minute readMedicare Part D, also known as a Prescription Drug Plan (PDP), helps people with Medicare pay for their medication. These plans are purchased from private health insurance providers and come with a variety of benefits and premiums. But for some high-usage Medicare enrollees, they can also come with unexpected expenses, called the Medicare Part D […]

![Learn How ACA Subsidies Work]()

Learn How ACA Subsidies Work

3-minute readThe U.S. government provides federal subsidies for health insurance to qualified individuals to make health insurance more accessible for Americans with lower to moderate incomes. These Affordable Care Act (ACA) subsidies, sometimes referred to as “Obamacare subsidies,” help reduce the cost of health insurance premiums and come in two basic forms: premium tax credits and […]