Related resources

![QUIZ: How do I know if my child has asthma?]()

QUIZ: How do I know if my child has asthma?

4-minute readTake this quiz to learn more about the signs and symptoms of this common childhood illness. Asthma is a chronic lung condition that affects people of all ages. And about 4.7 million children in the United States have it. If your child has asthma, it means that they have inflamed airways, which are the tubes […]

![How much life insurance for my children should I buy?]()

How much life insurance for my children should I buy?

2-minute readYou’ve already answered one important but difficult question: do you need life insurance for your children? Now, it’s time to decide how much. The decision will depend on your goals, how much you’re comfortable paying, and how much coverage you want. How much life insurance do you need for children? At the minimum, you want […]

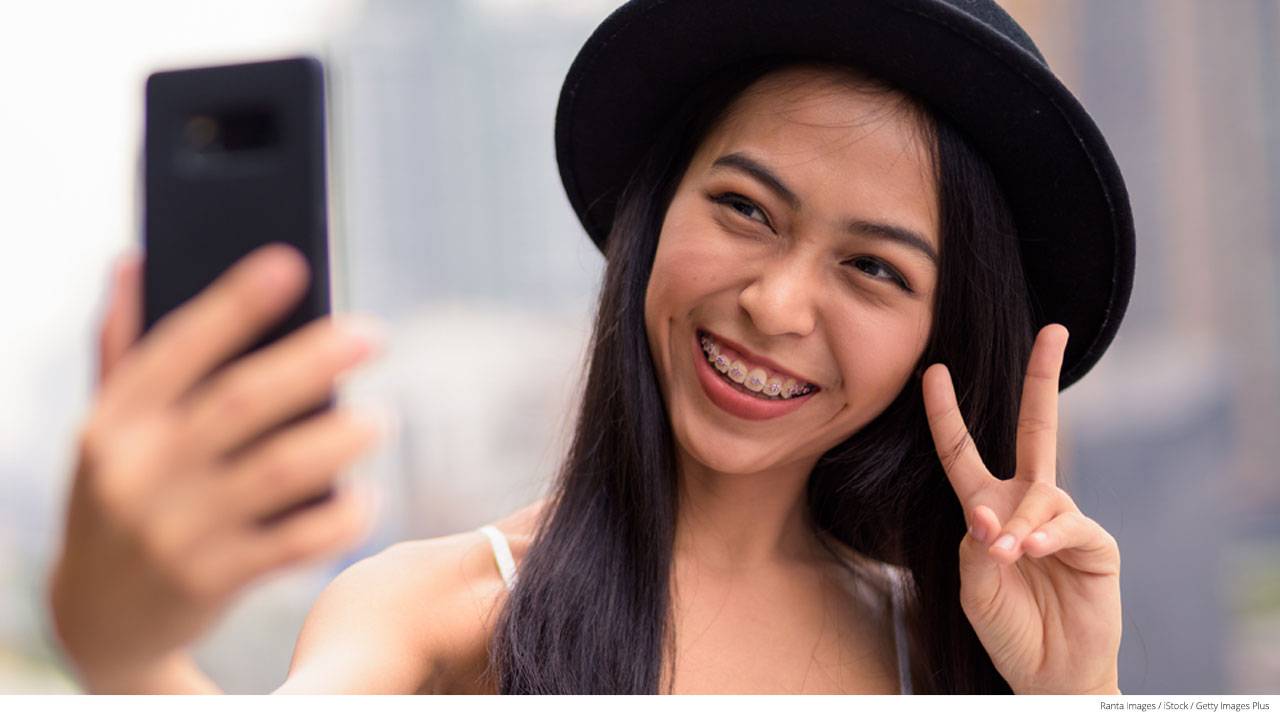

![Supplemental Orthodontic Insurance: 4 Smile-Friendly Tips]()

Supplemental Orthodontic Insurance: 4 Smile-Friendly Tips

3-minute readNeed braces for you or your kid? If you’re worried it’s going to be expensive, you’re not alone. The good news: with supplemental orthodontic insurance, it could be more affordable than you think. Without insurance, the average cost for braces is $5,000 to $6,000.1 But the more orthodontic care you need to fix your teeth, […]

![Transferring your life insurance to your child]()

Transferring your life insurance to your child

< 1-minute readIf you have a large estate, your beneficiaries will likely pay high estate taxes upon your death. If you have a life insurance policy, its value is considered part of your estate. This is why some people consider transferring their life insurance policies to their children. Changing Life Insurance Ownership Transferring ownership of a life insurance policy […]

![Do I need life insurance for my children?]()

Do I need life insurance for my children?

4-minute readThe fact that you are even asking the question, “Does my child need life insurance?” is a great step in the right direction. When we think about purchasing a life insurance policy to protect our children, usually the idea of insuring ourselves is what we have in mind. But there are many other ways you […]

![Do You Need Life Insurance for Teenagers?]()

Do You Need Life Insurance for Teenagers?

5-minute readShould you get life insurance for teenagers? You want the best for your teen, now and in the future. If you’re thinking about life insurance for teenagers, there’s some specific benefits and advantages to getting a policy. Here’s what you need to know about coverage options and costs to get life insurance for your teenager: […]

![How Much Life Insurance for My Grandchildren Should I Buy?]()

How Much Life Insurance for My Grandchildren Should I Buy?

7-minute readWondering about life insurance for grandchildren? You’ve probably heard it’s a way to: Support your grandkids Help pay for college, even after you’re gone Or a way to help your adult children if the unthinkable happens Chances are pretty good you’ve got questions about life insurance for grandchildren. Right? Don’t worry. We’ll answer your questions […]

![Supplemental Vision Insurance: 10 Clear Benefits You May Need to See]()

Supplemental Vision Insurance: 10 Clear Benefits You May Need to See

6-minute readThinking you might need supplemental vision insurance to help keep your eyes healthy? See for yourself… About 12 million people age 40 and older in the U.S. have a vision problem. About 1 million people are blind. And about 11 million more have other types of vision impairments.1 Starting to get the picture? Taking care […]

![Accidents Happen. Are You Covered?]()

Accidents Happen. Are You Covered?

3-minute readYou may think that accident insurance is only for people who like extreme sports or rugged adventures. Plus, regular health insurance coverage is supposed to care of your basic medical needs and any emergencies that arise. After all, that’s what health insurance is for, right? Maybe, maybe not. Accidents happen more often than we’d like […]

![What Can Vision Insurance Do For You?]()

What Can Vision Insurance Do For You?

2-minute readWhat Is Vision Insurance? Vision insurance is a type of optional plan that can provide coverage for your eye care. As most health insurance policies don’t include vision coverage, consumers without a proper plan could experience high out-of-pocket expenses for eye exams and glasses. Read more below to learn about what vision insurance covers, and […]

![Health Insurance Options for Infants]()

Health Insurance Options for Infants

2-minute readEnsuring that your baby is adequately insured is important. After all, your newborn will probably see a doctor more often than anyone else in your family. HealthMarkets can walk you through health insurance options for infants so that you’re prepared before your baby arrives. You can even search, compare, and apply for a plan with […]

![Open Enrollment for Families]()

Open Enrollment for Families

3-minute readFor Affordable Care Act (ACA) plans, the Open Enrollment Period for families begins on November 1 and ends on December 15.¹ During that time, you are responsible for making sure that you and your dependents have health insurance. If you do not obtain health insurance, you may be subject to a fine depending on the […]