Related resources

![The Procrastinator’s Guide to Applying for an ACA Plan]()

The Procrastinator’s Guide to Applying for an ACA Plan

6-minute readIf you’re reading this story, we’re going to assume that you missed the Affordable Care Act (ACA) Open Enrollment deadline. If you’re keeping track, the 2022 Open Enrollment Period ended for most people on January 15, 2023, in most states. Or, maybe you’re in a state whose deadline was January 31 and that deadline slipped […]

![When Is Open Enrollment for 2024-2025?]()

When Is Open Enrollment for 2024-2025?

3-minute readThe 2025 Open Enrollment Period (OEP) begins November 1, 2025, and ends usually January 15, 2025, in most states.1 The chart below shows the 2025 OEP dates for the states that use the federal Health Insurance Marketplace. Coverage begins January 1. If you have a Special Enrollment Period, coverage will begin the first day of […]

![What the ACA metal levels mean, and which one is right for you]()

What the ACA metal levels mean, and which one is right for you

4-minute readHealthMarkets helps you choose the Affordable Care Act plan that’s best for you. Shopping for health insurance can be confusing. That’s one of the main reasons why Affordable Care Act (ACA) health plans have metal levels — bronze, silver, gold and platinum — that help offer clarity. Before you sign up for coverage, it’s important […]

![Use this simple guide to navigate the health insurace marketplace]()

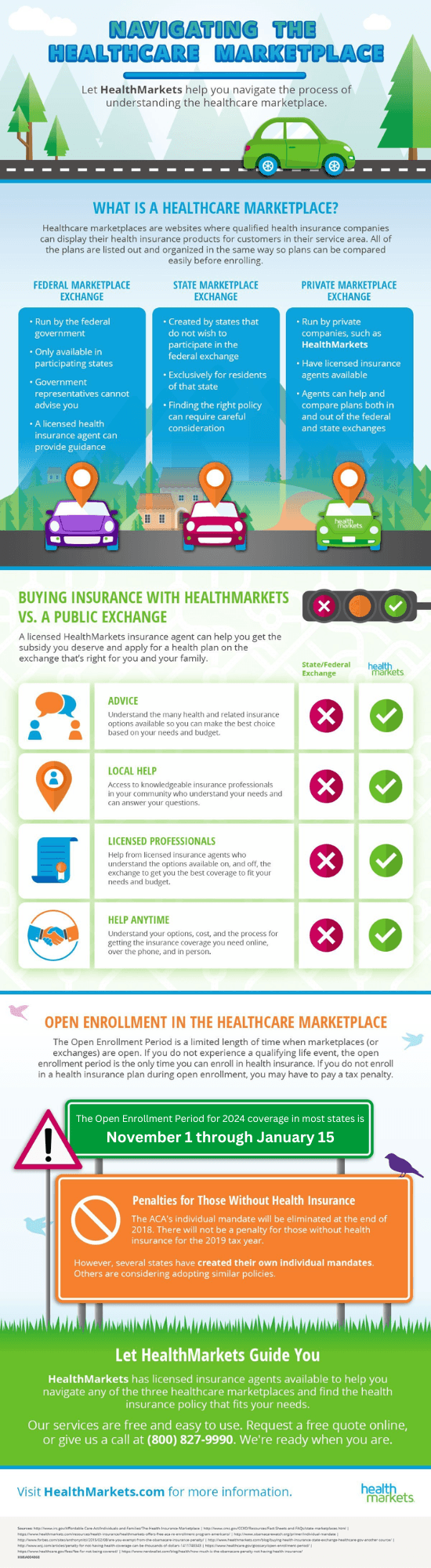

Use this simple guide to navigate the health insurace marketplace

4-minute readThere are three types of healthcare marketplaces. No matter which one you use, enroll in a plan before the enrollment period ends to secure coverage for the coming year.

![Picking a Healthcare Plan? 10 Smart Questions to Ask Your Insurance Agent]()

Picking a Healthcare Plan? 10 Smart Questions to Ask Your Insurance Agent

6-minute readKnowing that your healthcare costs are covered for the year ahead can be a big relief. Thankfully, millions of Americans have access to health insurance through the Affordable Care Act (ACA). The ACA’s marketplace lays out your health insurance options so you can shop for a plan that best fits your needs. You can also learn […]

![What’s changing about Affordable Care Act benefits in 2023?]()

What’s changing about Affordable Care Act benefits in 2023?

4-minute readIf you follow the news, you know that federal governing constantly changes. What was done one way today could be done much differently tomorrow. That can also apply to Affordable Care Act (ACA) health plans, which the government sells on its federal marketplace. So if you’re thinking about renewing your plan or buying an ACA […]

![Affordable Care Act Insurance: Renewing Your Plan]()

Affordable Care Act Insurance: Renewing Your Plan

3-minute readWant to renew the Affordable Care Act (ACA) insurance plan you had last year? It’s the easiest way to go. Right? If your plan provided you with the health insurance you needed for healthcare, doctor’s visits, medications, and other healthcare needs, automatic re-enrollment might make sense. Were the premiums and out-of-pocket expenses affordable? Did you […]

![I Lost My Job! Should I Do COBRA or ACA?]()

I Lost My Job! Should I Do COBRA or ACA?

3-minute readLosing your job comes with many headaches, including a change in health insurance in many cases. COBRA coverage is one option, but so is a plan under the Affordable Care Act (ACA). So how do you know which one to choose? The decision may be easier than you think. What’s the difference between COBRA and ACA? It may seem like you’re […]

![The Affordable Care Act and Taxes: What You Need To Know]()

The Affordable Care Act and Taxes: What You Need To Know

2-minute readIf you are one of millions of Americans who bought health insurance through a government exchange, filing your taxes could be slightly more complicated when tax season occurs. Different rules also apply depending on which U.S. state you live in. HealthMarkets can help explain the basics of the Affordable Care Act and taxes. IRS Form […]

![What You Need to Know About ACA Mental Health Coverage]()

What You Need to Know About ACA Mental Health Coverage

2-minute readWhile many Americans once lacked insurance coverage to pay for mental health treatment, the Affordable Care Act (ACA) has helped change that. Here are answers to some frequently asked questions about ACA mental health coverage. Do ACA Plans Cover Mental Health? The Affordable Care Act covers mental health and substance abuse disorder services. One of […]

![The Pros and Cons of the Affordable Care Act]()

The Pros and Cons of the Affordable Care Act

2-minute readThe Affordable Care Act (ACA) has garnered a lot of debate since its implementation in 2010. The market continues to change as the healthcare reform debate continues. Initially, many health insurance companies—lacking the information they needed to ensure their financial stability—left the ACA’s marketplaces. As the marketplace stabilized, some companies returned, and others continue to […]

![The 10 Essential Health Benefits: All You Need to Know]()

The 10 Essential Health Benefits: All You Need to Know

2-minute readSince 2014, the Affordable Care Act (ACA) has mandated that insurance plans cover 10 specific services. This mandatory list of services applies to many individual health plans or plans offered through the small-group marketplace (employers with up to 50 employees). Because these general services have been deemed “essential,” they are known as the 10 Essential […]